Good fifteen-seasons re-finance can save several thousand dollars, however will be prepare yourself to spend fifteen-year re-finance settlement costs. This is what you may anticipate.

Reducing your mortgage label with a good 15-season repaired-rate mortgage has some benefits. You ought to make sure you’ll get good price after you re-finance.

A great fifteen-seasons bucks-out refi is a smart way to pay for a property update project: overall performance enhancements, kitchen renovations, system reputation and more.

15-12 months FHA streamline re-finance costs shall be a financially rewarding real estate financing with a high return on investment. Today’s pricing bring borrowers a great deal more solutions.

Getting prequalified to possess good 15-seasons fixed-price re-finance now offers the newest definitive information you need so you can create a well-informed decision.

If you ordered a pricey home nowadays, it could be returning to a good fifteen-seasons jumbo refi. Accessibility down prices and better terms and conditions.

The best refinance price to have 15-year home loan solutions will be different over time. Dont anticipate prices to reduce on upcoming days otherwise months.

Having a predetermined-rates fifteen-season re-finance, you can reduce how long it will require for your house. Safer a diminished interest and to change monthly costs.

Then it is important to learn regardless if you are a good candidate for a shorter name and you can what to expect in financing techniques

A jumbo re-finance makes it possible to reduce your rates, shorten your own title, or alter your domestic. The method just means a few procedures, and you can certification is not difficult once you work at just the right bank. Discover more in this post.

You may be tempted to have fun with a credit card otherwise coupons membership to cover property improvement. not, you have additional options, and additionally with the funds from a funds-out refinance. Find out the ins and outs of refinancing to own renovations.

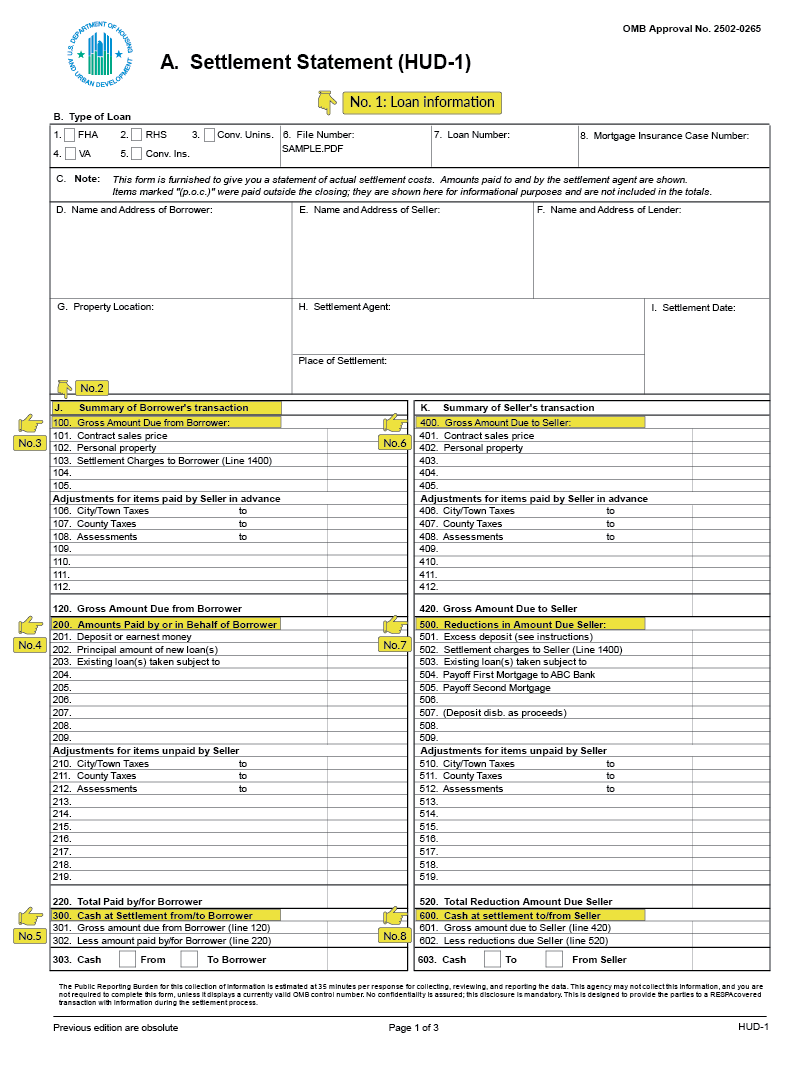

You will find different varieties of closing costs that include a beneficial domestic selling. If or not using him or her initial or over living of your financing, there is lots to look at before generally making one to decision.

Have fun with bucks-out finance to invest in a property improvement project and you can grow your property’s worth

Are you looking for ways to availableness their guarantee given that an excellent resident? You will must check out a money-aside refinance or family security personal line of credit (HELOC). Keep reading even as we mention one another loan choices.

In case your home loan is now into the forbearance on account of COVID-19, you happen to be questioning as much as possible re-finance and take advantage from the present lower prices. See paydayloancolorado.net/arboles/ which standards just be sure to fulfill and if or not refinancing just after forbearance is a possible choice for you.

Residents looking to refinance need to now make up an “bad field commission” applied from the Federal national mortgage association and you can Freddie Mac. Keep reading to learn more about brand new charges and why you is to nonetheless think a mortgage refinance.

With financial cost from the list downs, countless homeowners manage take advantage of good refinance. Listed below are some what you should remember prior to beginning the application.

Refinancing to the a good fifteen-seasons financial could potentially save you hundreds of thousands of dollars. But is it the proper monetary disperse for your requirements? Here’s what you have to know.

Refinancing their mortgage makes it possible to consolidate high-focus personal debt and shorten your loan name. In addition, you can even manage to skip or delay a few mortgage repayments after you re-finance. This is what you need to know prior to closing.

A mortgage re-finance will save you money from the cutting your rates, reducing mortgage insurance rates, and/or shortening your label. But how a couple of times are you able to refinance your home? Know about the brand new limitations and you will whether or not a great refinance is reasonable to own your.